CAR LOAN EMI CALCULATOR

What is Toolerz Car Loan EMI Calculator?

Toolerz Car Loan EMI Calculator is a Free Online tool that helps users to Estimate the Monthly EMI of their New car Loan.

This tool provides users with valuable insights into their monthly loan repayments, helping them budget effectively and plan for the future.

It considers key inputs such as the loan amount, interest rate, and loan tenure to calculate the monthly EMI of your Car Loan.

Using this tool, users can also estimate the monthly EMI of used car loans.

How to use Toolerz Car Loan Calculator

It is very simple to use our free online tool. You can simply calculate the estimated monthly repayment in just 3 steps.

Step 1: Visit our website www.toolerz.com and search for "Car Loan EMI Calculator"

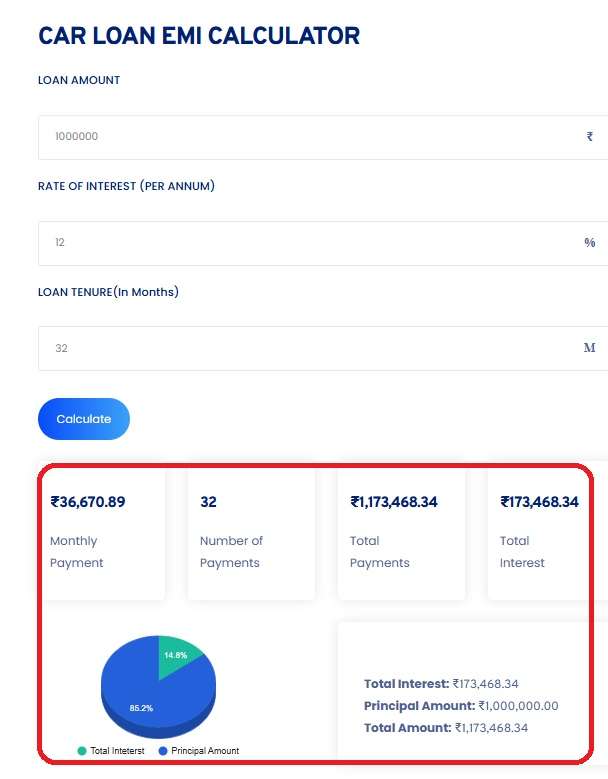

Step 2: Enter the input variables like Loan Amount, Interest Rate, and Tenure.

Step 3: Lastly, you can hit the calculate button to get the monthly EMI amount

Apart from monthly repayment, our tool also provides information on Total Payments in the Tenure, Total Interest Payable, and No. of Payments

This tool simplifies financial planning by giving you a clear breakdown of your EMIs, making it easier to manage your budget. For two-wheeler loans, you can also check out our Two Wheeler Loan EMI Calculator to compare repayment options.

How does it work?

After entering the input parameters like loan amount, tenure, and interest rate, our Car Loan EMI Calculator computes the monthly installment amount, including both principal and interest components.

It also provides a detailed repayment schedule, showing the breakup of each payment over the loan tenure.

All these computations are done at the backend and the final result will be displayed to the users within a second.

What is the Amortisation Schedule?

An amortisation schedule is a detailed table that shows how a loan is repaid over time through regular installments. Each payment in the schedule is broken down into two parts: principal (the original loan amount) and interest (the cost of borrowing).

This schedule helps borrowers clearly understand how much of each EMI (Equated Monthly Installment) goes toward reducing the loan balance and how much is paid as interest.

In the early stages of a loan, a larger portion of the payment goes toward interest. Over time, more of the payment is applied to the principal.

An amortisation schedule is useful for financial planning, tracking loan progress, and knowing the total interest cost over the loan tenure.

It provides transparency and helps borrowers manage their payments better, whether it's for a home loan, car loan, or personal loan. It’s a smart tool for staying on top of your loan repayment journey.

What Is the Rule for Car EMI?

The rule for calculating a car EMI (Equated Monthly Installment) depends on three key factors: loan amount, interest rate, and loan tenure.

A common financial rule is the 20/4/10 rule—you should pay at least 20% of the car’s price as a down payment, take a loan for no more than 4 years, and ensure that your EMI doesn't exceed 10% of your monthly income.

Car EMI is calculated using the formula:

EMI = [P × R × (1+R)^N] / [(1+R)^N – 1],

where P is the loan amount, R is the monthly interest rate, and N is the number of EMIs.

Before choosing a loan, it’s wise to use an EMI calculator to estimate monthly payments.

Always compare interest rates and repayment terms from multiple lenders to get the best deal and ensure the EMI fits comfortably within your budget.

Key Features of Car Loan EMI Calculator

A Car Loan EMI Calculator is a simple and effective tool that helps you estimate your monthly loan repayments with ease.

One of its key features is instant calculation just enter the loan amount, interest rate, and tenure, and the tool quickly shows your monthly EMI.

The calculator also provides a clear breakdown of interest and principal, helping you understand how your payments are structured over time.

It allows you to adjust different values to compare loan options and choose what best fits your budget.

Another great feature is its user-friendly interface, which makes it accessible even if you’re not financially savvy.

By using the calculator, you can plan your car purchase better, avoid surprises, and make informed decisions.

Whether you're buying a new or used vehicle, the car loan EMI calculator is a must-have tool for smart financial planning.

You can also explore our Personal Loan Calculator for managing different loan types.

Benefits of Car Loan EMI Calculator

It is always advisable to check the monthly re-payment amount before taking up any loan. Based on the EMI amount you can accordingly decide on various factors like how much loan to take, and the tenure you are comfortable with.

Apart from this, this tool has many other benefits, all are listed below.

Helps in Financial Planning:

The Car Loan EMI Calculator provides users with a clear understanding of their monthly EMI, making it easier to budget and plan for expenses.

By knowing the fixed EMI amount in advance, we can plan the finances effectively and ensure that we can comfortably meet the loan repayments without straining our budgets.

Loan Comparisons:

This tool allows borrowers to compare different loan options by adjusting parameters such as loan amount, interest rate, and tenure. This comparison enables borrowers to choose the most suitable loan option that fits their financial needs.

Quick and Easy to Use:

Our Car Loan EMI Calculator is quick, convenient, user-friendly, and hassle-free. Borrowers can obtain instant results without the need for complex manual calculations, saving time and effort.

Applications of Using Car Loan EMI Calculator

A Car Loan EMI Calculator is a practical tool that helps individuals plan their car purchase with better financial clarity. One of its key applications is calculating the exact monthly installment (EMI) based on the loan amount, interest rate, and repayment period.

This allows users to budget effectively and choose a loan that fits their income and lifestyle. It also helps in comparing different loan offers from banks or financial institutions, making it easier to select the most affordable option.

Additionally, the calculator shows the total interest payable and the overall cost of the loan, giving a clear picture of the financial commitment. Whether you're buying a new or used car, this tool ensures transparency and smarter decision-making.

It is especially useful for first-time buyers, helping them avoid hidden costs and stay financially prepared. Overall, a Car Loan EMI Calculator simplifies the car buying process and promotes better financial planning.

Frequently Asked Questions

Q1. How does the Toolerz Car Loan EMI Calculator differ from a regular Calculators?

Ans: While a regular EMI calculator can be used for any type of loan, Toolerz Car Loan EMI Calculator is specifically designed for calculating the EMIs of car loans. Apart from EMI, this tool also have additional features such as options to factor in car-related expenses like insurance, taxes, and registration fees.

Q2. Are there any additional costs not included in the EMI calculation?

Ans: While the Car Loan EMI Calculator calculates the monthly installment based on the loan amount and interest rate, there will be some additional charges such as processing fees, prepayment charges, and insurance premiums, which may not be reflected in the EMI calculation.

Q3. Why should I use a Car Loan EMI Calculator?

Ans: Using a Car Loan EMI Calculator helps you:

Plan your loan repayment easily.

Compare different loan options and interest rates.

Adjust the loan amount or tenure based on your budget.

Q4. Can I prepay my car loan?

Ans: Yes, most banks allow prepayment or foreclosure of car loans. However, some lenders may charge a prepayment penalty, so check the terms before paying early.

Q5. Is the Car Loan EMI Calculator accurate?

Ans: Yes, it gives a close and reliable estimate based on the numbers you enter. The final EMI may slightly vary depending on the bank’s exact terms, but the calculator is very useful for planning.

Q6. Is the Car Loan EMI Calculator free to use?

Ans: Absolutely! It is free and available online. You don’t need to sign up or pay to use it www.toolerz.com .

Q7. Can I use a Car Loan EMI Calculator to calculate my down payment?

Ans: No, a Car Loan EMI Calculator is specifically for calculating your monthly installments based on the loan amount, interest rate, and tenure. The down payment is typically a separate calculation and is usually paid upfront, reducing the loan amount you need.

Q8. Can I change the loan amount or tenure after calculating the EMI?

Ans: Yes, you can adjust the loan amount, interest rate, and loan tenure in the Car Loan EMI Calculator to see how changes affect your monthly EMI. This allows you to experiment with different scenarios and choose the one that suits your financial situation best.

Q9. What is a Car Loan EMI Calculator?

Ans: A Car Loan EMI Calculator is an online tool that helps you find out how much you will need to pay every month if you take a loan to buy a car. It gives you the EMI (Equated Monthly Installment) based on the loan amount, interest rate, and repayment period.

Q10. Can I change the loan details to compare options?

Ans: Yes! You can try different amounts, interest rates, or loan durations to see how they affect your EMI. This helps you choose the best loan offer for your needs.

Q11.Does it show the total interest I will pay?

Ans: Yes. Along with the EMI, the calculator also shows the total interest amount and the total cost of the loan over the chosen period.