PERSONAL LOAN CALCULATOR

What is Toolerz Personal Loan Calculator?

Toolerz Personal Loan Calculator is a free tool that helps you calculate your monthly Equated Monthly Installment (EMI) and the total interest payable on a personal loan.

Our calculator is designed to help users make decisions by providing a clear view of their financial obligations before applying for a loan.

How to Use Our Personal Loan Calculator

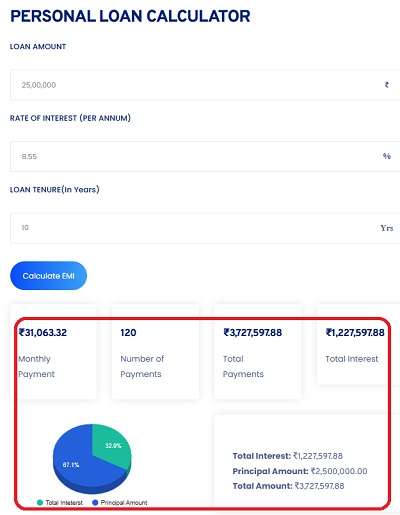

- Visit the Calculator Page: Go to Toolerz.com and navigate to the Personal Loan Calculator.

- Input the Principal Amount: Enter the total amount of loan you intend to borrow.

- Select the Loan Tenure: Choose the duration for which you want the loan, usually between 1 to 5 years.

- Enter the Interest Rate: Provide the applicable interest rate as offered by your bank or lender.

- Click on Calculate: Hit the calculate button to instantly see the EMI, total interest payable, and total loan amount.

- Review the Results: Analyze the graphical representation and detailed breakdown to make an informed decision.

Key Features of Personal Loan EMI Calculator

A Personal Loan EMI Calculator is a handy online tool that helps users estimate their monthly loan repayments with ease.

One of its key features is instant calculation—simply enter the loan amount, interest rate, and tenure, and it shows your EMI within seconds.

It is user-friendly, with a clean interface that makes it easy to use even for those with no financial background.

The calculator provides a detailed breakup of principal and interest, giving better insights into your repayment schedule.

It also allows you to adjust different loan variables to compare EMI outcomes, helping you choose a plan that fits your budget.

Most tools offer amortization charts for a visual understanding of how your loan reduces over time. Accessible 24/7 online, it is a time-saving and error-free way to plan your loan repayments smartly and efficiently.

Benefits of Using Personal Loan Calculator

A personal loan calculator is a smart financial tool that helps you estimate your monthly payments and overall loan cost before applying.

One of the main benefits is clarity it allows you to input the loan amount, interest rate, and repayment term to instantly see your expected EMI (Equated Monthly Installment).

This helps in planning your budget and avoiding surprises. The calculator also lets you compare different loan options side by side, so you can choose the most affordable one.

It’s perfect for understanding how factors like loan duration or interest rate affect your payments.

Most personal loan calculators are free, easy to use, and available online anytime. Whether you're taking a loan for travel, education, or emergency expenses, this tool helps you make informed decisions.

By using a personal loan calculator, you can manage your finances better and borrow with confidence.

Functionality

Our Personal Loan Calculator is built to provide accurate and quick calculations by taking into account three main factors:

- Principal Amount: The total amount of loan you plan to borrow.

- Interest Rate: The rate charged by the lender for providing the loan.

- Loan Tenure: The time period over which the loan needs to be repaid.

By inputting these parameters, the calculator uses a standard EMI formula to compute the monthly installment and total interest.

For savings-related calculations, check out our FD Calculator to estimate your fixed deposit returns effectively.

Personal Loan EMI Calculator

The Personal Loan EMI Calculator is an essential feature of our tool. It breaks down the EMI into two parts:

- Principal Component: The part of the EMI that goes towards repaying the original loan amount.

- Interest Component: The part of the EMI that covers the interest charged by the lender.

Applications of Personal Loan Calculator

A Personal Loan Calculator is a handy financial tool that helps users estimate their monthly EMI (Equated Monthly Installment) before applying for a loan.

Its primary application is to provide a clear picture of repayment amounts based on the loan amount, interest rate, and tenure. This helps individuals plan their budgets better and avoid any financial strain.

It’s widely used by borrowers to compare loan offers from different banks or financial institutions, making it easier to choose the most affordable option.

The calculator also helps in understanding the total interest payable over the loan period, which is crucial for making informed decisions.

Financial planners, loan agents, and online lenders often integrate personal loan calculators into their platforms to offer quick, transparent estimates.

Overall, it simplifies the loan planning process, reduces the chances of default, and promotes smart financial decisions by offering instant, accurate insights.

Bank-wise Personal Loan Interest Rates

Different banks offer varied interest rates for personal loans. Here’s a comparative table of the interest rates offered by major banks:

| Bank Name | Interest Rate (per annum) |

|---|---|

| State Bank of India (SBI) | 9.60% - 15.65% |

| HDFC Bank | 10.50% - 21.00% |

| ICICI Bank | 10.75% - 19.00% |

| Axis Bank | 10.49% - 20.00% |

| Kotak Mahindra Bank | 10.99% - 24.00% |

| Punjab National Bank | 8.95% - 15.00% |

| Bajaj Finserv | 11.99% - 15.50% |

| Yes Bank | 10.75% - 20.00% |

| Bank of Baroda | 9.85% - 16.00% |

Best Bank for Personal Loan

The best bank for a personal loan depends on various factors, such as the interest rate, processing fees, repayment flexibility, and customer service. Here are a few top choices:

- State Bank of India (SBI): Known for competitive interest rates and excellent customer service.

- HDFC Bank: Offers quick approval and disbursement, ideal for emergency needs.

- ICICI Bank: Provides flexible repayment options and minimal documentation.

- Axis Bank: Competitive rates and the option of a longer tenure.

- Kotak Mahindra Bank: High loan amount eligibility and fast processing.

Importance of CIBIL Score for Personal Loan

A good CIBIL score is crucial for securing a personal loan at favorable terms. Banks use this score to assess the creditworthiness of a borrower.

A higher CIBIL score (typically above 750) can help you secure lower interest rates and faster approval.

ROI Based on CIBIL Table

| CIBIL Score Range | Expected ROI Range (%) |

|---|---|

| 750-900 | 10.00% - 12.00% |

| 700-749 | 12.50% - 15.00% |

| 650-699 | 15.50% - 18.00% |

| 600-649 | 18.50% - 22.00% |

| Below 600 | Above 22.00% |

Personal Loan for Government vs. Private Employees

Government Employees: Generally receive lower interest rates due to job stability and guaranteed income. Banks often provide special schemes for them.

Private Employees: May face slightly higher interest rates. The rates depend on the employer’s reputation, the employee’s salary, and the duration of employment.

Advantages of Personal Loan EMI Calculator

A Personal Loan EMI Calculator offers several advantages that make financial planning easier and more accurate.

One of the main benefits is quick and error-free results—you can calculate your EMI within seconds without manual math.

It helps you plan your budget effectively by showing how much you need to pay each month, ensuring there are no surprises.

You can compare different loan amounts, tenures, and interest rates to find the best repayment option suited to your needs.

It also gives a clear picture of the total interest payable, helping you make informed borrowing decisions. The calculator is free, easy to use, and accessible anytime online, making it a convenient tool for both first-time borrowers and experienced users.

Overall, a Personal Loan EMI Calculator empowers you with better control over your finances and loan choices, promoting smarter money management.

How Are Personal Loan Rates Calculated?

Personal loan interest rates are primarily determined based on factors like your credit score, income, loan amount, tenure, and the lender's policies. Lenders assess your creditworthiness to determine the risk of lending money to you.

A higher credit score generally results in a lower interest rate, as it indicates that you are a less risky borrower. Your income and employment status also play a role in this calculation, as lenders prefer borrowers who have a stable income.

Additionally, the loan amount and repayment period influence the rate smaller loans or shorter tenures may attract lower rates.

Lenders may also consider the type of loan, whether secured or unsecured, with secured loans often carrying lower rates.

Lastly, market conditions and the lender's profit margins also affect the interest rate offered. Be sure to compare various lenders to get the best deal on your personal loan.

How to Increase Your CIBIL Score

- Pay Your Bills on Time: Regularly pay all your bills, especially credit card bills and existing loan EMIs, on or before the due date.

- Reduce Outstanding Debt: Avoid carrying a high balance on your credit card and reduce the overall debt.

- Maintain a Healthy Credit Mix: A balanced mix of secured (home, auto) and unsecured (personal) loans positively affects your score.

- Monitor Your Credit Report: Regularly check your credit report for any errors or discrepancies.

- Avoid Multiple Loan Applications: Multiple loan applications can negatively impact your score. Apply only when necessary.

For a broader view of your financial commitments, check out our EMI Calculator to calculate EMIs for various loans and ensure that you are prepared for your monthly obligations.

Frequently Asked Questions

Q1. What is a Personal Loan Calculator, and how does it work?

Ans: A Personal Loan Calculator is a tool that helps users estimate the monthly EMI (Equated Monthly Installment) and total interest payable on a personal loan. By inputting the loan amount, interest rate, and tenure, the calculator provides an accurate breakdown of the monthly payments.

Q2. How accurate is your Personal Loan Calculator?

Ans: Our Personal Loan Calculator uses advanced algorithms and the latest data to ensure highly accurate calculations. The results provided are precise and reliable, but small variances may occur based on the bank's terms, conditions, and additional charges.

Q3. Can I use the Personal Loan Calculator for loans other than personal loans?

Ans: Yes, you can use it to estimate EMIs for other types of loans (such as car loans or home loans), provided you input the correct principal amount, interest rate, and tenure. However, it is primarily designed for personal loans.

Q4. Does the calculator consider prepayment or part-payment options?

Ans: No, the basic calculation assumes that the loan is repaid in equal monthly installments without any prepayment or part-payment. However, you can manually adjust the inputs to estimate the effects of prepayments by reducing the principal amount.

Q5. How do I know if I am eligible for a personal loan?

Ans: Eligibility depends on several factors, including age, income, employment status, CIBIL score, and debt-to-income ratio. Use our calculator to estimate the EMI based on your affordability, and check with banks for their specific eligibility criteria.

Q6. Does the calculator provide a breakdown of principal and interest components in EMI?

Ans: Yes, our Personal Loan Calculator offers a detailed breakdown of the EMI into the principal and interest components, helping you understand how much of your payment goes toward the principal and how much goes toward interest.

Q7. How can I use the Personal Loan Calculator to compare different loan offers?

Ans: Enter the loan amount, tenure, and interest rate for each loan offer into the calculator. Note the EMI results, total interest payable, and total cost of the loan. Compare these values to decide which loan is the most cost-effective for you.

Q8. Is there any cost associated with using the Personal Loan Calculator on your website?

Ans: No, our Personal Loan Calculator is completely free to use. There are no hidden charges, registration fees, or usage costs.

Q9. How does the loan tenure affect the EMI?

Ans: A longer loan tenure reduces the monthly EMI but increases the total interest paid over the loan term. Conversely, a shorter tenure results in a higher EMI but a lower total interest cost. The calculator helps you find the right balance.

Q10. How does my CIBIL score affect the personal loan EMI calculation?

Ans: A higher CIBIL score usually results in a lower interest rate, which reduces the EMI. Use our calculator to see how different interest rates (based on your CIBIL score) affect your monthly payments.

Q11. Can I save the results from the Personal Loan Calculator for future reference?

Ans: Currently, the calculator does not offer a built-in save feature. However, you can take a screenshot or note down the results manually for future reference.

Q12. Are the interest rates shown in the calculator up to date?

Ans: Our calculator uses the most recent data available, but interest rates can fluctuate frequently. Always check with your bank for the most accurate and up-to-date rates.

Q13. What is the difference between a flat interest rate and a reducing balance rate, and does the calculator support both?

Ans: A flat interest rate applies the same interest rate on the entire principal throughout the loan tenure, while a reducing balance rate calculates interest on the remaining loan balance. Our calculator uses the reducing balance method, which is common for personal loans.

Q14. Is the calculator mobile-friendly?

Ans: Yes, the Personal Loan Calculator is fully optimized for mobile devices, tablets, and desktops, ensuring you can access it anytime and anywhere.

Q15. Can the Personal Loan Calculator help me decide the right loan amount to borrow?

Ans: Yes, by adjusting the principal amount and observing the resulting EMI, you can determine a loan amount that fits your monthly budget and repayment capacity.

Q16. Why Should I Use a Personal Loan Calculator?

Ans: Using a personal loan calculator helps you:

Plan your monthly budget effectively

Compare different loan offers

Understand the total interest payable

Decide on a suitable loan tenure

Q17. Does the personal loan calculator include additional fees?

Ans: No, most personal loan calculators focus only on the loan principal and interest rate. Additional fees, such as processing fees, late payment penalties, or insurance charges, may not be included in the calculation. Make sure to check with your lender for the complete cost of the loan.

Q18. Is the personal loan calculator free to use?

Ans: Yes, most personal loan calculators online are completely free. You can use them anytime to calculate your EMIs and plan your loan repayment easily.https://www.toolerz.com/

Q19: Do I need to register or pay to use the Personal Loan Calculator?

Ans: No, most Personal Loan Calculators are completely free and available online. You don’t need to sign up or share any personal information to use them.

Q20: Can the calculator be used for any bank’s personal loan?

Ans: Yes, you can use it for any bank or lender. Just enter the correct interest rate and tenure as per the lender’s offer to get accurate results.

Q21: What is a Personal Loan EMI Calculator?

Ans: A Personal Loan EMI Calculator is an online tool that helps you calculate your monthly loan repayment (EMI). It shows how much you will need to pay every month based on your loan amount, interest rate, and loan tenure.