TWO WHEELER LOAN EMI CALCULATOR

What is Toolerz Two Wheeler Loan EMI Calcualtor?

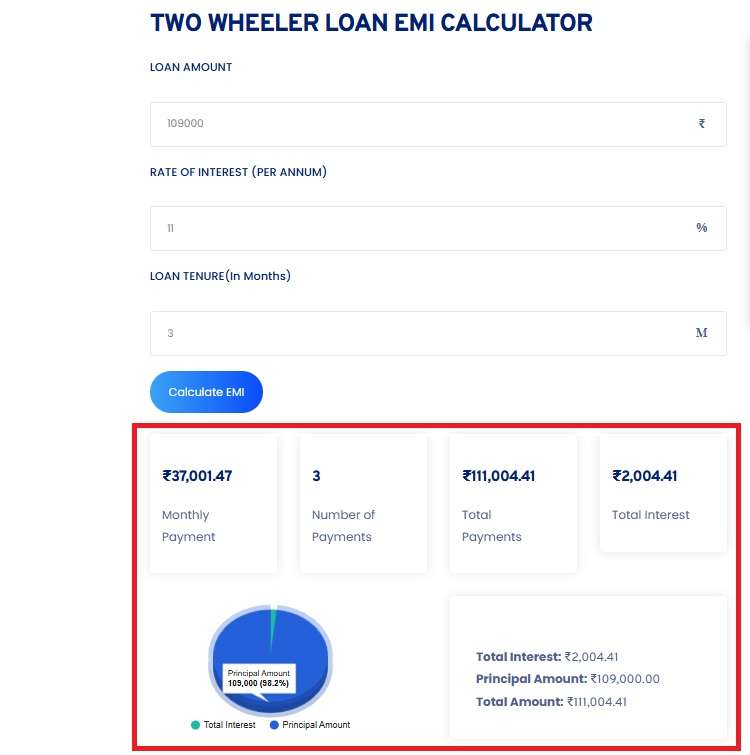

Using Toolerz Two Wheeler Loan EMI Calculator you can calculate the EMI of your vehicle Loan from any Bank like HDFC, SBI, Kotak, Canara, IndusInd, etc.,

Our Two-Wheeler Loan EMI Calculator empowers you with financial transparency. No more complicated calculations or guesswork – simply input the loan amount, interest rate, and tenure to instantly get your monthly EMI.

Make informed decisions about your budget and choose a loan that matches with your financial goals.

How to use Two Wheeler Loan Calculator

Are you in search of a loan to own a two-wheeler? Here is the free online tool to calculate your Bike loan EMI simply. We have provided the step-by-step procedure to calculate the bike loan EMI online.

Step 1: Enter the website: www.toolerz.com and search for "Two Wheeler Loan EMI Calculator" in the search bar.

Step 2: A new page opens and enter the following details

1. Loan amount

2. Tenure, and

3. Interest Rate

Note: Illustration states to enter the details in blanks, such as amount (INR 1,00,000), tenure (18 years), interest rate (20.90 percent), and click the calculate button.

And, you will find the calculated monthly installment as INR 6,519.

Note: In this case, you can find the loan calculator for a two-wheeler at leading banks such as ICICI Bank, SBI, Kotak Bank, Bajaj Finserv, Axis Bank, HDFC Bank, etc.,

Once you are determined to buy a bike, then you can make an easy online calculation of the loan amount by using the two-wheeler loan calculator.

For that, you will require three variables, and they are loan amount, tenure, and interest rate on the loan amount.

You can easily obtain a two-wheeler loan by producing the following documents fulfilling the eligibility criteria and signing in to make the payment of the associated fees and relevant charges.

Benefits of Two Wheeler Loan EMI Calculator

A Two Wheeler Loan EMI Calculator is a practical tool that helps you plan your bike or scooter purchase with confidence.

One of the key benefits is accurate EMI estimation—just enter the loan amount, interest rate, and tenure, and the calculator instantly shows your monthly installment.

This makes it easier to budget effectively and choose a loan amount that fits your financial comfort zone. It also saves time by eliminating the need for manual calculations or complex formulas.

With a clear idea of monthly obligations, users can avoid surprises and manage repayments responsibly. The calculator also allows you to compare different loan options, helping you select the most affordable and suitable plan.

Whether you’re buying a scooter for daily commute or a premium bike, this tool empowers smarter borrowing decisions.

Easy to use and accessible online, it’s a must-have for anyone considering a two-wheeler loan.

Eligibility for Two Wheeler Loan:

Individuals:

You can belong to the salaried class/self-employed.

You must belong to the age group of 21 years to 65 years.

You must be earning at least INR 10,000 per month.

Non Individual Entities:

You must be a registered nonindividual entity such as a private limited company, government company, or partnership firm.

Key Features of Two Wheeler Loan EMI Calculator

The Two Wheeler Loan EMI Calculator is a handy online tool that helps users estimate their monthly loan repayments quickly and accurately.

One of its key features is ease of use—just enter the loan amount, interest rate, and loan tenure to get instant EMI results.

It provides a clear breakdown of the monthly EMI, total interest payable, and overall repayment amount, making financial planning simpler.

The calculator allows users to adjust different values to compare loan scenarios and choose the most suitable repayment plan.

It's accessible anytime online, helping buyers plan their bike purchase without visiting a bank. Another standout feature is transparency—it helps users understand the cost of the loan upfront, preventing financial surprises later.

Whether you're planning to buy a scooter or a motorbike, this calculator supports smart budgeting and informed decision-making.

What Is the Formula for Calculating EMI for a Two-Wheeler Loan?

To calculate the EMI (Equated Monthly Installment) for a two-wheeler loan, you can use the standard EMI formula:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

P = Loan amount (principal)

R = Monthly interest rate (annual rate ÷ 12 ÷ 100)

N = Loan tenure in months

For other financial calculations, don’t forget to try our Financial Calculator to get accurate insights into your finances.

This formula helps you estimate the fixed amount you’ll pay every month, including both principal and interest. It’s useful for planning your budget and ensuring that your loan stays affordable throughout the repayment period.

You can also use online EMI calculators offered by banks and lenders for quick results. Just enter the loan amount, interest rate, and tenure to get your monthly EMI instantly. This makes it easier to compare loan offers and choose the best option for your two-wheeler purchase.

SBI Two Wheeler Loan EMI Calculator

State Bank of India (SBI) offers affordable interest rates for purchasing two-wheelers in the EMI scheme. With SBI's two-wheeler loan EMI, customers can pay the loan amount flexibly, making it easier to afford their desired vehicle.

Before taking a loan on your two-wheeler vehicle, calculate the EMI using the tool "Two Wheeler Laon EMI Calculator"

The EMI amount for SBI two-wheeler loans is calculated based on factors such as the loan amount, interest rate, and tenure.

Enter the above input parameters & get the estimated monthly repayment and approach the bank accordingly.

Documents Required for Two Wheeler Loan in HDFC Bank:

When applying for a two-wheeler loan, you must submit identity proof, address proof, and income proof when applicable.

Identity Proof:

As proof of identity, you can submit proof such as an election/voter identity card, permanent driving license, or Aadhar card ( updated within thirty days).

Address Proof:

Utility bill in the name of customer, property or municipality tax receipt, pension or family pension payment orders, PPO's, letter of allotment of accommodation for government employees or private company/firms employees.

Income Proof whenever necessary:

You must submit three months' previous bank statements/latest ITR for self-employed.

If you're considering a car purchase, check out our Car Loan Calculator for accurate loan estimates.

What is the Rule for Calculating EMI?

EMI (Equated Monthly Installment) is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. The rule for calculating EMI involves three main components: the loan amount, the interest rate, and the loan tenure.

The formula to calculate EMI is:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1 + r)^n}{(1 + r)^n - 1}EMI=(1+r)n−1P×r×(1+r)n

Where:

-

P is the principal loan amount

-

r is the monthly interest rate (annual interest rate divided by 12)

-

n is the loan tenure in months

EMI calculations help borrowers understand how much they need to pay each month. The rule ensures that the total amount paid is spread evenly across the tenure, making it easier to budget. Understanding this rule allows borrowers to make informed decisions about their loans and repayments.

Fees & Charges at HDFC Bank:

The HDFC bank shall collect two-wheeler loan charges in areas such as rack interest rate (14.5%), loan processing charges (2.5%), documentation charges (2%), registration certificate RC collection fees (INR 600), and stamp duty fees (in accordance with state laws).

These charges keep changing from time to time.

Loan Repayment Fee Charges:

You will have to pay the charges of, Post loan disbursement, Premature closure charges, Other charges if applicable

Applications of Two Wheeler Loan EMI Calculator

The Two Wheeler Loan EMI Calculator is a practical tool used by both individuals and financial planners to estimate monthly loan payments before purchasing a bike or scooter.

One major application is budgeting—it helps users determine if the EMI fits within their monthly income, ensuring a stress-free repayment journey.

It’s also helpful for comparing different loan options by varying interest rates, loan amounts, and tenures to find the most affordable plan.

Dealerships and loan agents often use it to quickly assist customers in understanding their financing options.

Additionally, it supports transparent decision-making by breaking down the total repayment amount and interest cost, helping users avoid hidden charges.

Whether you’re planning a short-term or long-term loan, this calculator simplifies financial planning, allowing users to confidently choose the best loan offer.

It’s especially valuable for first-time buyers who want clarity before committing to a financial agreement.

FAQ

Q1:How is EMI calculated for 2 wheeler loan?

Ans: EMI for 2 wheeler is calculated using formula P x R x (1+R)^N / [(1+R) ^N-1] where P is Principal Amount,R is Rate of Interest and N represents number of months of payment

lets take an example:

Total amount took loan(P) is 50,000

Overall Rate of Interest(R) is 12%

Number of Payments is(N) 36

Q2: Which bank is best for 2 wheeler loan?

Ans: To know which bank is best for taking 2 wheeler loan, We need to select the lowest rate of interest giving by banks in that financial year, Rate of Interest is also decide on based on cibil score of user who is availing loan.

Q3:What is the EMI for 1.5 lakh bike loan?

Ans: Lets assume you are taking loan amount of total 1.5 lakhs of loan with rate of interest of 9.5% for tenure of 18 months then expected Monthly EMI would be 8,974.07 for detail information please find image below

Q4: Can I buy two-wheeler without downpayment?

Ans: Yes, If you meet with criteria with respective bank for loan of total amount of your 2 wheeler you are purchasing

Q5: Is 2 wheeler loan taxable?

Ans: If you purchased for self usag, you cannot claim for tax exemption, Incase if you are purchasing the 2 wheeler for business purpose it is possible to claim for tax exemption under section 80C of the Income Tax Act, 1961.

Q6: What details do I need to use the calculator?

Ans: To use the calculator, you typically need:

The total loan amount

The interest rate offered by the lender

The loan tenure or duration in months or years

Q7: What is a Two Wheeler Loan EMI Calculator??

Ans:A Two Wheeler Loan EMI Calculator is an online tool that helps you estimate your monthly installment for a two-wheeler loan. It shows how much you need to pay each month based on the loan amount, interest rate, and loan tenure.

Q8: Does the calculator show the exact EMI amount I will pay?

Ans:It shows an accurate estimate based on the details you provide. The actual EMI may differ slightly depending on the lender's terms, processing fees, or other charges.

Q9: Do I have to pay to use a two-wheeler EMI calculator?

Ans:No, it's free to use. Most online EMI calculators are completely free and available anytime.

Q10: Why should I use a two-wheeler loan EMI calculator before applying for a loan?

Ans:Using the calculator helps you plan your monthly budget. It gives a clear idea of how much you’ll need to pay every month and helps you choose a loan that suits your income and needs.

Q11: Is the Two Wheeler EMI Calculator free to use?

Ans:Yes, it’s completely free. You can use it as many times as you like to try different values and choose the best loan plan for you.https://www.toolerz.com/

Q12: Is the Two Wheeler Loan EMI Calculator accurate?

Ans:It gives a good estimate based on the inputs you provide. Actual EMIs might vary slightly due to processing fees or changes in interest rates.