INTEREST CALCULATOR

What is Toolerz Interest Calculator?

Toolerz Interest Calculator is an online tool that calculates both Simple Interest & Compound Interest.

There are primarily two types of interest: simple interest and compound interest, and our tool can be used for both calculations.

How to Use Our Interest Calculator?

Using our Interest Calculator at Toolerz is very simple, even a beginner can access this tool. Follow these simple steps to utilize the tool:

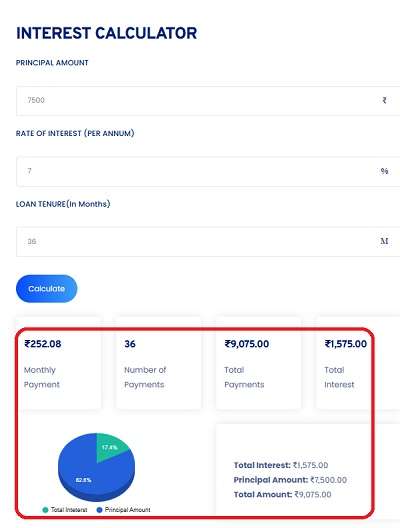

- Visit the Interest Calculator page on Toolerz (search for the tool on the home page).

- Input the principal amount: This is the initial sum of money you want to calculate the interest on.

- Enter the rate of interest: This is the annual interest rate in percentage.

- Choose the time period: Enter the duration in months for which the interest needs to be calculated.

- Select the type of interest: Choose between Simple Interest or Compound Interest.

- For Compound Interest: You need to specify the compounding frequency (annually, semi-annually, quarterly, etc.).

- Click on Calculate: Hit the calculate button, the tool will compute and display the interest amount.

Our tool also includes additional options for calculating monthly interest and interest for specific durations like 6 months.

Key Features of Interest Calculator

An interest calculator is an essential tool for anyone involved in financial planning or investment.

One of its key features is the ability to calculate both simple and compound interest, helping users understand how their money grows over time.

It allows you to input variables like principal amount, interest rate, and time period to easily compute interest on savings, loans, or investments.

The calculator also provides flexibility by offering different compounding frequencies, such as annually, quarterly, or monthly.

This allows users to visualize how different compounding options affect the overall return.

Another useful feature is the ability to compare various scenarios by adjusting the interest rate or time frame.

This can be particularly beneficial for individuals planning for future financial goals like retirement or education.

Overall, an interest calculator provides clarity, making it easier for users to make informed financial decisions.

For more personalized financial calculations, check out our Car Loan Calculator.

Benefits of Using an Interest Calculator

An interest calculator is a handy tool that helps you quickly calculate how much interest you will earn or pay on a loan, savings, or investment.

One of the biggest benefits is accuracy—it eliminates guesswork and manual errors when dealing with financial figures.

It saves time by instantly showing results for simple or compound interest based on the input values like principal amount, interest rate, and time period.

This is especially helpful when comparing different loan or investment options to make better financial decisions.

Whether you're planning to take a loan, open a fixed deposit, or invest in mutual funds, an interest calculator helps you forecast returns or EMIs with ease.

It also supports better financial planning by giving a clear picture of how your money grows or how much you owe over time.

Simple Interest Calculator

Simple Interest is calculated on the original principal throughout the duration of the investment or loan.

The formula for Simple Interest is:

Simple Interest (SI)=P×R×T/100

Where:

P= Principal Amount

R= Rate of Interest

T= Time Period in Months

For example, if you invest Rs. 5,000/- at an interest rate of 5% for 3 years, the simple interest would be:

SI = 5000x5x3/100

SI = 750

Thus, the interest earned would be Rs. 750/-

Compound Interest Calculator

Compound Interest is calculated on the principal amount as well as the interest that has been added to the principal over time.

The formula for Compound Interest is:

Compound Interest (CI)= P(1+(R/100))T - P

Where:

P = Principal amount

R = Annual interest rate

T = Time period (in years)

n = Number of times interest is compounded per year (optional)

What is 7% of 10,000?

To calculate 7% of 10,000:

7%×10000=(7/100)×10000=700

So 7% of 10000 is Rs. 700/-

For a healthier financial and personal life, check out our BMI Calculator to maintain a balanced lifestyle.

How Do People Calculate Interest?

People calculate interest to know how much extra money they will earn or pay over time on savings, loans, or investments. The two most common types are simple interest and compound interest.

Simple Interest is calculated using the formula:

Interest = (Principal × Rate × Time) / 100

Here, the principal is the amount, the rate is the annual interest rate, and time is in years.

Compound Interest is calculated on both the principal and the interest earned over time. The formula is:

A = P × (1 + R/100)^T, where A is the final amount, P is the principal, R is the rate, and T is the time in years.

Compound interest grows faster and is often used for savings and investments, while simple interest is common in short-term loans.

Applications of Interest Calculator

Interest calculators have wide range of applications in finance segment:

- Personal Savings: Calculate the future value of savings with interest.

- Loans: To calculate the total interest paid on loans and mortgages.

- Investments: Estimate the potential return on investment for a given interest rate and time period.

- Credit Cards: Calculate interest accrued on credit card balances.

- Mortgages: Determine how much interest is paid over the life of a mortgage.

Advantages of Using an Interest Calculator

An interest calculator is a valuable tool for quickly and accurately computing interest on savings, loans, or investments. One of its key advantages is time-saving—users can get instant results without needing to perform complex formulas manually. This is especially useful for comparing different interest rates and time periods.

Another benefit is accuracy. Manual calculations can lead to errors, but a digital interest calculator ensures precise results every time. It also helps users visualize financial growth, whether it's through simple or compound interest, giving a clearer understanding of how money grows over time.

Additionally, it supports better financial planning by helping individuals and businesses forecast earnings or expenses more effectively. Whether you're managing a loan, evaluating savings, or budgeting for future goals, an interest calculator simplifies the process and boosts financial confidence. It’s a must-have tool for anyone looking to make informed and smart money decisions.

Key Features of Using an Interest Calculator

An interest calculator is a simple yet powerful tool designed to help users quickly determine the interest earned or paid on a sum of money. One of its key features is its ability to calculate both simple and compound interest, giving flexibility based on user needs. It allows you to input the principal amount, interest rate, time period, and compounding frequency to generate accurate results.

Another valuable feature is real-time calculation, which saves time and reduces manual errors. Many interest calculators also offer visual breakdowns, such as tables or graphs, to help users understand how their money grows over time. They are user-friendly and accessible online, requiring no technical expertise.

Whether you’re a student, investor, or borrower, an interest calculator provides a quick and clear understanding of financial projections, making it easier to plan and compare different financial scenarios. It’s an essential tool for smart money management.

Frequently Asked Questions

Q1: What is the difference between simple and compound interest?

Ans: Simple interest is calculated on the original principal only, while compound interest is calculated on the principal and any accumulated interest.

Q2: Can I calculate monthly interest using this Interest Calculator?

Ans: Yes, you can calculate monthly interest by choosing the "monthly" option and adjusting the time period accordingly.

Q3: Is the Toolerz Interest Calculator free to use?

Ans: Yes, our Interest Calculator is completely free to use www.toolerz.com .

Q4: Can I calculate interest for a specific period like 6 months?

Ans: Yes, simply adjust the time period in the calculator to reflect 6 months.

Q5: How accurate is this Interest Calculator?

Ans: Our Interest Calculator provides highly accurate results based on the data provided, we can say our tool is 100% accurate.

Q6: Does the calculator work for all currencies?

Ans: Yes, the calculator works universally. You just need to input the correct values regardless of the currency.

Q7: What is the compounding frequency, and how does it affect interest?

Ans: Compounding frequency refers to how often interest is added to the principal. Higher frequency results in more interest.

Q8: Can I calculate daily interest?

Ans: Yes, you can calculate daily interest by adjusting the time period

Q9: How does the tool handle different interest rates over time?

Ans: For multiple rates over time, the calculator currently uses the specified rate, so for varying rates, calculations need to be done for each period separately.

Q10: Why should I use an Interest Calculator?

Ans: An Interest Calculator helps you:

Estimate how much interest you will earn on investments.

Calculate the interest payable on loans or credit.

Compare different interest rates for better financial decisions.

Save time and avoid manual calculations.

Q11: Can an Interest Calculator be used for loans and investments?

Ans: Yes, an Interest Calculator is useful for both. You can calculate the interest for personal loans, home loans, or car loans, as well as fixed deposits, savings accounts, or mutual funds.

Q12:Why is an interest calculator useful?

Ans: An interest calculator helps you plan your finances better. It shows you how much your money will grow in a savings account or how much you’ll have to repay on a loan.

Q13:How can I use the Interest Calculator for investments?

Ans: For investments, input the initial amount invested, the interest rate, and the time period. The calculator will show you how much your investment will grow, helping you plan your savings effectively.

Q14:Is this calculator useful for students and beginners?

Ans: Yes, it is very helpful for students learning about interest and also for anyone new to savings, loans, or investing. It uses simple math and gives clear results.

Q15:Can I calculate interest for partial years or months?

Ans: Yes, most interest calculators allow you to enter time in months or years, so you can get accurate calculations even for shorter periods.