HOME LOAN EMI CALCULATOR

What is Toolerz Home Loan EMI Calculator?

Toolerz Home Loan EMI Calculator is an online tool offered for free that helps the users calculate the EMI they need to pay for their home loan.

This tool is designed to give users an accurate estimate of their monthly repayments, making it easier for them to plan their expenses.

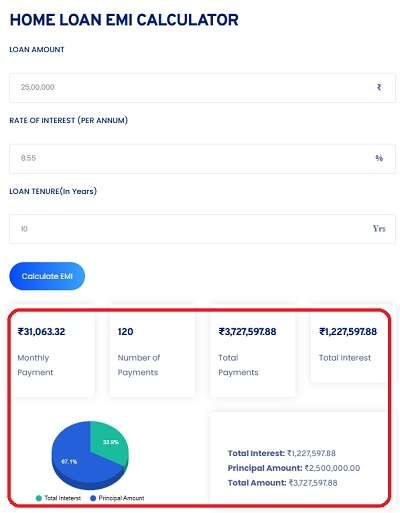

Our tool calculates EMI based on the loan amount, interest rate, and loan tenure.

By providing input details into the calculator, users can easily calculate their monthly EMI of their home loan.

How to Use Our Calculator

If you do not know how to use our tool, just follow the below steps:

- Visit the Calculator Page: If you don't have direct page link, you can simply go to the home page & search for "Home Loan EMI Calculator" and navigatte to the page.

- Enter the Loan Amount: Provide the total loan amount you want to take.

- Enter the Interest Rate: Enter the applicable interest rate provided by the bank.

- Select the Loan Tenure: Choose the duration over which you plan to repay the loan in years.

- Click on Calculate: Once all the details are filled in, click the ‘Calculate EMI’ button.

- The calculator will display your monthly EMI along with a detailed breakdown of the total interest payable and the overall repayment amount.

Benefits of Our Home Loan EMI Calculator

- User-Friendly Interface: All our tools are designed with easy-to-access features & excellent User Interface that ensures a smooth user experience.

- Accuracy: The calculations provided by our tool are highly accurate, ensuring that users get exact figures when compared to the bank calculations.

- Instant Calculation: Our tool instantly calculates the EMI & displays on the screen with in no time.

- Detailed Breakdown: Our calculator provides a detailed breakdown of the EMI, including principal and interest components.

What is Home Loan Amortization Schedule?

A home loan amortization schedule is a detailed table that shows how your loan is repaid over time through regular monthly payments.

It breaks down each installment into two parts: principal (the amount you borrowed) and interest (the cost of borrowing).

In the early years of your loan, a larger portion of your payment goes toward interest, while the principal repayment increases gradually over time.

The schedule also shows your outstanding loan balance after each payment, helping you track your progress.

This tool is useful for planning your finances, understanding how long it will take to repay the loan, and how much interest you’ll pay in total.

It can also help you decide if making extra payments will save you money in the long run.

What is the EMI for a 20 Lakh Home?

Using our tool let us calculate the house loan EMI for a loan amount of 20 lakh rupees.

To calculate the EMI for a 20 lakh home loan, let us assume an interest rate of 7.5% per annum and a loan tenure of 20 years.

- Loan Amount: ₹20,00,000

- Interest Rate: 7.5% per annum

- Loan Tenure: 20 years (240 months)

If you enter the above inputs to our calculator, it gives the results as shown below:

Monthly EMI Amount: ₹16,111.86/-

Total Interest Payable: ₹1,866,847.33

Therefore, the EMI for a 20 lakh home loan at 7.5% interest for 20 years is approximately ₹16,112.

How Much Home Loan Can I Get on ₹50,000 Salary Per Month?

The amount of home loan you can get is determined by your income, repayment capacity, age, and other financial commitments.

Banks generally follow a thumb rule where the EMI should not exceed 40-50% of your monthly income. And it also checks your CIBIL score, other active loans, and the previous loan repayment history.

Let us consider you have a good CIBIL score and a good history of loan repayments:

Assuming an EMI affordability of 50% of your income:

- Monthly Salary: ₹50,000

- Maximum EMI: 50% of ₹50,000 = ₹25,000

Using the same interest rate of 7.5% per annum and a tenure of 20 years:

Thus, on a ₹50,000 monthly salary, you can get a home loan of approximately ₹31 lakhs.

How Much Home Loan Can I Get on ₹25,000 Salary?

Using the same scenario as above:

- Monthly Salary: ₹25,000

- Maximum EMI: 50% of ₹25,000 = ₹12,500

Using the same interest rate of 7.5% per annum and a tenure of 20 years:

Thus, on a ₹25,000 monthly salary, you can get a home loan of approximately ₹15.5 lakhs.

SBI Home Loan EMI Calculator

The State Bank of India (SBI) offers a user-friendly home loan EMI calculator on its website. Here’s how you can use it:

- Visit SBI’s Official Website: Navigate to the home loan EMI calculator section.

- Enter Loan Details: Fill in the loan amount, interest rate, and tenure.

- Click Calculate: The EMI and a detailed repayment schedule will be displayed.

SBI’s calculator is known for its accuracy and user-friendly interface. It also provides options for different types of home loans offered by SBI.

You can also use the same tool as the SBI Home Loan EMI Calculator by providing the interest rates given by SBI.

Home Loan Eligibility Calculator

A home loan eligibility calculator helps determine the amount you are eligible to borrow based on your income, age, and other financial obligations.

Here is how to use it:

- Enter Personal Details: Enter your age, monthly income, and employment type.

- Provide Financial Obligations: Mention any existing EMIs or other financial commitments.

- Calculate Eligibility: The calculator will display the maximum loan amount you are eligible for.

For better financial management, you can also explore our FD Calculator to calculate fixed deposit returns and grow your savings efficiently.

Key Features of Using Home Loan EMI Calculator

A Home Loan EMI Calculator is a powerful tool that simplifies the process of determining your monthly loan payments.

One of the key features is its ability to calculate EMIs based on loan amount, interest rate, and loan tenure, giving users a clear understanding of their monthly financial obligations.

The calculator is highly user-friendly, with a simple interface that requires minimal inputs, allowing anyone to quickly determine their EMI without complex manual calculations.

It also provides instant results, helping you plan your finances effectively.

Another important feature is its ability to compare different loan terms and interest rates, giving you the flexibility to choose the best home loan option for your needs.

The tool ensures financial transparency by providing a clear breakdown of monthly payments, helping you avoid surprises and make informed decisions.

Overall, the home loan EMI calculator is an indispensable tool for budgeting and loan management

Home Loan Interest Rate

Home loan interest rates in India vary depending on the lender, loan amount, and the borrower’s credit profile.

As of 2024, home loan interest rates range between 6.5% and 9%.

The following are the primary factors influencing the interest rates:

- Credit Score: Higher credit scores typically attract lower interest rates.

- Loan Amount: Larger loan amounts might come with slightly higher interest rates.

- Loan Tenure: Longer tenures can sometimes result in higher interest rates.

- Type of Interest: Fixed vs. floating interest rates.

You can also use our BMI Calculator to keep track of your health while you manage your finances.

How to Calculate Home Loan EMI with Simple Interest?

Calculating your home loan EMI using simple interest is straightforward. Simple interest is calculated only on the principal amount, not on the interest accrued. The formula is:

EMI = (Principal × Rate × Time) / (12 × Time)

Here, the principal is the loan amount, the rate is the annual interest rate, and time is the loan period in years. Multiply the loan amount by the interest rate and tenure (in years), then divide the result by 12 × number of years to get the monthly EMI.

For example, a ₹10 lakh loan at 8% interest for 10 years:

EMI = (10,00,000 × 0.08 × 10) / (12 × 10) = ₹6,666.67

This method gives you a basic estimate, though most banks use compound interest. Use a loan calculator for more accuracy if your loan uses monthly reducing balance.

Documents Required for Home Loan in India

Applying for a home loan in India requires several documents, which include:

- Identity Proof: Aadhar card, PAN card, passport, or driving license.

- Address Proof: Utility bills, rental agreement, or passport.

- Income Proof:

- Salaried: Salary slips, Form 16, and bank statements.

- Self-Employed: IT returns, balance sheets, and profit & loss statements.

- Property Documents: Sale deed, property tax receipts, and NOC from the builder.

- Other Documents: Passport-sized photographs, application form, and processing fee cheque.

Advantages of Using a Home Loan EMI Calculator

A home loan EMI calculator is a powerful tool for simplifying financial planning when purchasing a property. It helps borrowers accurately estimate their monthly payments based on the loan amount, interest rate, and tenure.

By providing instant results, it enables users to compare different loan offers and choose the most affordable option.

This calculator also assists in budgeting by giving a clear picture of monthly financial commitments, preventing overburdening. Additionally, it helps in understanding how changes in loan tenure or interest rates impact EMIs, allowing borrowers to make informed decisions.

With its user-friendly interface, a home loan EMI calculator saves time, minimizes errors, and enhances financial clarity, making it an essential resource for prospective homebuyers.

Frequently Asked Questions

Q1: What is the Toolerz Home Loan EMI Calculator?

Ans: Toolerz home loan EMI calculator is an online tool that helps you calculate the monthly EMI for your home loan based on the loan amount, interest rate, and tenure.

Q2: How accurate is the Toolerz home loan EMI calculator?

Ans: Our home loan EMI calculator is highly accurate as it uses the standard EMI calculation formula. Using this tool you can calculate the Home loan EMI of any bank like SBI, HDFC, ICICI, KOTAK Bank, IndusInd, etc.,

Q3: Can I use the calculator for different loan amounts and tenures?

Ans: Yes, you can adjust the loan amount and tenure to see how they affect your EMI.

Q4: Is this calculator free to use?

Ans: Yes, our home loan EMI calculator is free to use www.toolerz.com .

Q5: What information do I need to provide to use the EMI calculator?

Ans: You need to enter the loan amount, interest rate, and loan tenure to use the calculator.

Q6: Does the calculator consider processing fees?

Ans: No, the calculator only considers the loan amount, interest rate, and tenure.

Q7: Can I use the calculator for any type of home loan?

Ans: Yes, the calculator can be used for any type of home loan from any bank.

Q8: How often should I use the EMI calculator?

Ans: You can use it as often as needed, especially when planning your finances or comparing loan offers.

Q9: Does the EMI amount change over time?

Ans: For a fixed-rate loan, the EMI remains the same. For a floating-rate loan, the EMI can change based on the interest rate fluctuations.

Q10: Can I calculate EMI for joint home loans?

Ans: Yes, the calculator can be used for joint home loans by considering the combined loan amount and tenure.

Q11: Is it necessary to register to use the EMI calculator?

Ans: No, registration is not required to use our EMI calculator and also no need to pay any fee.

Q12: Can the calculator be used for refinancing?

Ans: Yes, you can calculate the EMI for re-financing also.

Q13: Why should I use a Home Loan EMI Calculator?

Ans: A Home Loan EMI Calculator is helpful because it:

✔ Saves time by providing quick results.

✔ Helps you plan your budget better.

✔ Allows you to compare different loan options.

✔ Gives a clear idea of how interest rates and loan tenure affect your EMI.

Q14: Does the calculator show only the EMI amount?

Ans: Many home loan EMI calculators also show the total interest payable and the total amount you will pay over the entire loan period.:

Q15: What are the benefits of using a Home Loan EMI Calculator before applying for a loan?

Ans: It helps you understand your monthly financial commitment, compare loan offers from different banks, and plan your repayment easily without any surprises later.

Q16: Will the Home Loan EMI Calculator tell me the total amount I will pay over the loan term?

Ans: Yes, many Home Loan EMI Calculators will show you the total amount paid over the tenure. This total is the sum of all your EMIs, including the principal and interest. It helps you understand the overall cost of the loan.

Q17:Do I need to sign up to use the calculator?

Ans: No, most home loan EMI calculators are free and available online without any sign-up or download..