FD CALCULATOR

How to Calculate FD?

Toolerz FD Calculator is a Free Online Tool that helps you calculate your returns on your Fixed Deposits in any Bank like SBI, HDFC, Post Office, ICICI, PNB, etc.,

Making precise calculations of the maturity value of an FD account is tiresome work but the FD calculator tools make your work much simpler than ever, and, in a split second the calculator provides you with a solution.

A fixed deposit calculator is a well-designed software tool applicable to compare multiple banks at a time.

You will have to select the bank enter the details in the blanks and wait for the solution. Since each bank has its specific interest rates on FDs of different tenures, the maturity value differs. Thus making the FD tool a good comparison among different banks.

You are free to select the tenure from a few days to several years and get the corresponding maturity values most accurately.

These Fixed deposit calculators perform multiple activities like comparing the various public sector/private sector/rural scheduled banks.

FD calculators do help you in planning your financial objectives better in an error-free zone.

FD Calculator SBI

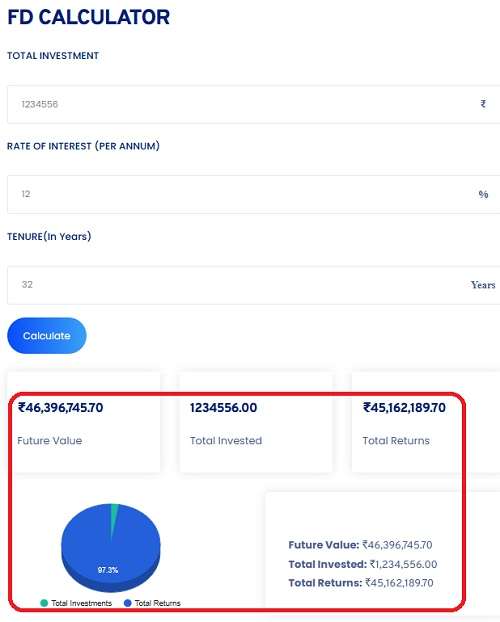

The image provided above is a prototype of the SBI FD calculator and has been selected by us for your better understanding. It is used to make calculations on fixed deposits.

The FD calculator contains several input variables such as bank name, date of opening of the fixed deposit, amount of deposit, frequency of payout, the deposit term, and rate of interest.

You will have to fill in with details as per your choice. Make a check of the input details and then click the calculate button.

The FD calculator will return the maturity value of the invested money and by changing the values of deposit term, deposit amount, frequency, and interest rate, you can obtain your desired maturity amount.

How Does an FD Calculator Help You?

FD calculators cannot calculate the amount of tax to be paid on your maturity value of the fixed deposits.

You can make a fixed deposit investment in a bank. In which, the banker issues a specific rate of interest for a specific period on the fixed deposit and you can collect the principal amount and the interest at the time of maturity.

But, how do the banks calculate your investment in the savings bank? Yes, they do integrate FD software calculating tools on the web pages to enable their clients to make the necessary calculations.

You too can utilize the FD calculators provided by the banks to calculate the estimated maturity return based on variables like invested money, tenure of investment, and the rate of interest.

These FD calculators are custom-made and they will enable you to make the entries of the variable with ease.

These calculating software tools use formulas in the calculators to deduce the maturity value of FDs and mathematical experts say two types of formulas are used that are based on simple interest, and compound interest.

However, for the interest of the readers, we have presented the formula used in calculating the maturity value the procedure for using FD calculators, and how helpful these FD calculators can be.

Benefits of FD Calculator

An FD (Fixed Deposit) Calculator is a smart tool that helps you estimate the maturity amount and interest earned on your investment.

One of the biggest benefits is quick and accurate calculations, saving time and effort compared to manual methods.

This tool allows you to plan your investments better by providing a clear picture of returns based on the deposit amount, interest rate, and tenure.

It’s especially helpful for comparing different bank FDs and choosing the one that offers the best returns.

An FD calculator also promotes informed financial decisions by letting you experiment with different values to see how changes affect your final earnings.

Whether you're a first-time investor or someone looking to grow savings safely, this tool makes financial planning easy.

Simple Interest FD Calculators:

Simple Interest FD calculators adopt a specific formula that helps you in making the calculations easier on the online FD calculator.

M = P(P x r x t/100),

P,r,t are the variables that keep changing as per your preferences.

P is the principal amount ( the invested money in the bank)

r is the annual rate of interest.

t is the tenure ( period of the investment)

In case you make a deposit of INR 2,00,000 for a period of 5 years at an interest rate of 10% then, you can calculate the maturity value by substituting the value of these variables in the formula.

M = 200,000 + (2,00,000 x 10 x 5/100)

= INR 300,000.

For more investment planning, check out our Macro PPF Calculator to calculate returns on your Public Provident Fund investments.

Compound Interest FD Calculators:

You can use Compound Interest FD calculators and perform computations in a very short time.

For the Compound Interest Calculators, the FD calculators will use the formula:

M = P + P { ( 1 + i/100) t - 1}

P, i, t are the variables that keep changing as per your choice.

p is the principal amount

i is the rate of interest.

t is the tenure ( period of investment).

For the same above example,

M = 2,00,000 { ( 1 + 10/100)5-1}

= 1,08,000.00

Why do FD Interest Rates Change Frequently?

A bank keeps on changing its FD rates for several reasons:

The central bank ( RBI) makes monetary policy decisions and this results in quick adjustments of the interest rates on the fixed deposit. Thus, the maturity value of the FDs do change and that may not match your financial objectives.

Banks are one of the biggest financial institutions and there is a constant pressure to maintain their position in the financial markets and therefore these banks keep changing interest rates.

You may prefer an investment tenure that may not yield your desired maturity value for your investments. Hence, you will have to go for high interest rates usually you obtain in a long term investment.

Your investment amount can also affect the rate of interest of a FD, for higher investments in FDs the banker will prefer to pay more return rate just to retain the customer.

Formula to Calculate FD Maturity Amount

Calculating the Fixed Deposit (FD) maturity amount helps you understand how much your investment will grow over time. The basic formula for FD maturity is:

A = P × (1 + r/n)^(n × t)

Where:

-

A = Maturity Amount

-

P = Principal Amount (initial deposit)

-

r = Annual interest rate (in decimal)

-

n = Number of times interest is compounded per year

-

t = Time in years

This formula is used when the interest is compounded periodically (quarterly, half-yearly, etc.). For simple interest FDs, the formula is:

A = P + (P × r × t)/100

Using these formulas, you can easily calculate how much your FD will be worth at the end of the term. Many online FD calculators also use these formulas to give you quick and accurate results, making financial planning easier and more effective.

What is the Benefit of FD Calculator?

An FD (Fixed Deposit) calculator is a simple yet powerful tool that helps investors estimate the maturity amount of their fixed deposit investment.

One of its key benefits is accuracy—it quickly calculates the interest you’ll earn based on the deposit amount, tenure, and applicable interest rate. This saves time and eliminates manual errors.

The FD calculator also helps in financial planning by allowing users to compare returns across different banks and tenures.

You can experiment with different amounts and durations to find the best option that suits your financial goals. It is especially helpful for both new and experienced investors looking for a safe and predictable return.

Using an FD calculator ensures transparency and helps you make informed decisions about your savings.

Whether you’re planning short-term or long-term investments, this tool provides clarity and control over your returns.

What Would Happen if an FD is Broken?

The basic principle is to retain the FD until it completes the maturity period your maturity value will attract a loss of interest and a penalty shall be applicable.

You can also explore our helpful tools like the Union Bank Sip Calculator to manage your investments better.

FD Deposits ( Term Deposit Scheme): Tax Implications

For fixed deposits, the tax is deducted at the source, and it is laid on the interest earned in the financial year.

A customer can earn income from a Fixed Deposit in form of interest up to INR 40,000.00 and for a fixed deposit invested by a Hindu undivided family, an interest earned up to INR 50,000.00 will not be taxed.

The bank TDS will deduct 10% on the interest before credited to the account.

You must give a self-declaration statement to the banker to avoid the tax deduction, and this is usually done by submitting the Form 15G, and Form 15H.

Key Features of Using FD Calculator

An FD (Fixed Deposit) calculator is a valuable tool that helps you estimate the maturity amount and interest earned on your fixed deposit.

One of its key features is ease of use—you simply enter the principal amount, interest rate, and deposit tenure to get instant results. It supports both simple and compound interest calculations, giving you a more accurate financial projection.

Another important feature is flexibility. You can compare multiple interest rates or tenure periods to choose the best FD plan for your financial goals.

FD calculators also offer real-time results, saving time and reducing manual errors in complex interest computations.

Many calculators support both cumulative and non-cumulative FDs, allowing users to assess different payout options. Whether you're a beginner or a seasoned investor, an FD calculator helps in better financial planning by giving a clear view of your investment growth over time.

Advantages of Using FD Calculator

An FD (Fixed Deposit) calculator offers a quick and easy way to estimate the maturity amount of your fixed deposit investment.

One of the biggest advantages is its accuracy it calculates interest earned based on principal amount, interest rate, and tenure, eliminating manual errors. It helps investors compare different FD options across banks or institutions to make informed decisions.

Using an FD calculator also saves time, especially when planning multiple investments with different amounts and durations.

It provides clarity on returns, helping users align their financial goals with their investment plans. Moreover, it promotes transparency, as you get a clear idea of how much your investment will grow over time.

Whether you’re a new or seasoned investor, an FD calculator is a helpful financial planning tool.

It brings confidence and simplicity to managing fixed deposits, allowing users to optimize their savings with minimal effort.

Frequently Asked Questions (FAQs)

Q1. What is an FD Calculator?

Ans: An FD Calculator helps you calculate the maturity amount and interest earned on a Fixed Deposit (FD) based on the deposit amount, tenure, and interest rate.

Q2. What are the benefits of using an FD Calculator?

Ans: ✔ Quick & Accurate – No need for manual calculations

✔ Compare FD Plans – Helps choose the best FD scheme

✔ Financial Planning – Estimate returns before investing

Q3. Can I use the FD Calculator for both banks and post office FDs?

Ans: Yes! The calculator works for bank FDs, post office FDs, and company deposits.

Q4. Does the calculator include tax deductions?

Ans: Most basic FD calculators show pre-tax returns. If you want to know the exact amount after tax, you may need to check tax rules or use a tax-adjusted FD calculator.

Q5. Is it free to use an FD Calculator online?

Ans: Yes, FD calculators available online are usually free to use. You can access them anytime without registering or paying any fee www.toolerz.com .

Q6. Why should I use an FD Calculator?

Ans: Using an FD calculator saves time, avoids manual mistakes, and helps you easily compare different banks or deposit options before investing.

Q7. Can I use an FD calculator for all banks?

Ans: Yes, an FD calculator can be used for any bank. Just enter the interest rate offered by your bank, and it will show the maturity value accordingly.

Q8. How does an FD Calculator work?

Ans: You need to enter the deposit amount, interest rate, and the time period. The calculator then shows your maturity value and how much interest you’ll earn.

Q9. Does the FD Calculator include taxes?

Ans: No, most calculators show the gross return. If you want to know the post-tax return, you should check the tax rules or consult with your bank.

Q10. Can I use it on my phone?

Ans: Absolutely! Most FD calculators are mobile-friendly and work well on smartphones, tablets, and desktops.

Q11. Is an FD calculator helpful for senior citizens?

Ans: Yes, it’s very useful because senior citizens often get higher interest rates, and the calculator can help them know their expected earnings.