PPF CALCULATOR

What is Toolerz PPF Calculator?

Toolerz PPF Calculator is a helpful tool for individuals looking to invest in a PPF to estimate the returns and manage their finances effectively.

Our advanced, user-friendly online PPF Calculator helps investors calculate the maturity value of their PPF investments over a specific period.

How to Use Our PPF Calculator

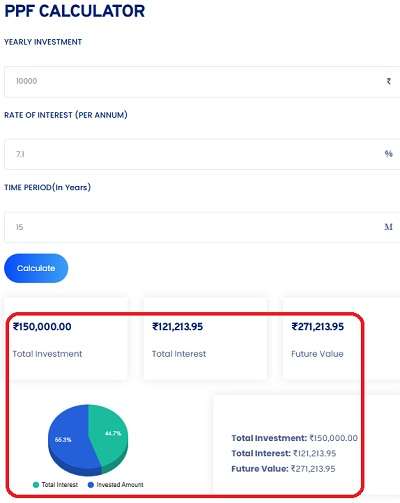

Using our PPF Calculator is simple. Here’s a step-by-step guide to help you calculate your PPF returns:

- Visit Our Website: Go to www.toolerz.com and enter 'PPF Calculator' tool.

- Enter Initial Deposit Amount: Input the initial amount you plan to invest in your PPF account. This amount can be between INR 500 and INR 1.5 lakh per annum.

- Select Monthly Contribution: Enter the monthly contribution amount you wish to invest. This can be any amount, but it must not exceed the maximum limit of INR 1.5 lakh per annum.

- Choose the Investment Tenure: Select the investment tenure in years. The minimum tenure for a PPF account is 15 years, which can be extended in blocks of 5 years.

- Input the Current PPF Interest Rate: Our calculator automatically updates the current PPF interest rate, but you can adjust it to see how different rates affect your returns.

- Click on Calculate: Once all the fields are filled in, click the 'Calculate' button to view your estimated maturity value, total contributions, and total interest earned.

Benefits of Using a PPF Calculator

A PPF (Public Provident Fund) calculator is a smart tool that helps you estimate the maturity amount of your PPF investments with ease and accuracy.

One of the key benefits is that it saves time by automatically calculating the interest earned over time based on your annual deposits, tenure, and current interest rate.

It gives you a clear picture of your long-term savings, helping you plan your finances better. Whether you're investing monthly or yearly, the calculator adjusts the figures to show how your money will grow over the 15-year lock-in period.

It’s ideal for individuals looking to build a secure retirement fund or save for future goals.

The tool is easy to use, requires no complex formulas, and helps avoid manual calculation errors.

By offering a visual view of your returns, a PPF calculator supports smarter, more confident investment decisions making it a valuable asset for every saver.

Functionality

Our PPF Calculator uses a formula based on compound interest to compute the returns on your PPF investment.

The formula takes into account factors such as the amount invested, the duration of investment, and the prevailing interest rate.

For more financial calculations, try our Interest Calculator to determine interest earnings on various investments.

Returns After 15 Years in PPF

Investing in a PPF account for 15 years can provide significant returns due to the power of compounding.

Here is an example:

- Monthly Contribution: INR 5,000

- Annual Contribution: INR 60,000

- Interest Rate: 7.1% (current rate)

- Duration: 15 years

Using the PPF Calculator, you can find that the maturity amount after 15 years would be approximately INR 16,27,284.

This includes the total investment of INR 9,00,000 and an interest earning of around INR 7,27,284.

Key Features of PPF Calculator

A PPF (Public Provident Fund) Calculator is a valuable tool designed to help users estimate the maturity value of their PPF investments with ease and accuracy.

One of its key features is the ability to calculate compound interest based on user inputs like annual deposit, duration, and current interest rate.

It provides a clear breakdown of yearly contributions, accrued interest, and total returns. The calculator is user-friendly and requires no technical knowledge—just enter a few details, and the results are instantly displayed.

It helps investors plan long-term savings more effectively by visualizing the growth of their funds over time.

Additionally, the tool is free to use and accessible online, making it convenient for anyone looking to manage their PPF account better.

With accurate results and quick calculations, the PPF Calculator supports smarter financial planning and goal setting.

PPF vs. SIP (Systematic Investment Plan)

- Risk: PPF is a government-backed, risk-free investment, while SIPs are market-linked and carry a certain level of risk.

- Returns: SIPs can potentially offer higher returns due to equity exposure but are volatile; PPF provides guaranteed returns.

- Tax Benefits: Both PPF and SIPs (under ELSS) offer tax benefits under Section 80C, but only PPF provides tax-free returns.

- Liquidity: SIPs offer better liquidity compared to PPF, which has a lock-in period of 15 years.

PPF vs. Sukanya Samriddhi Yojana (SSY)

- Target Audience: PPF is open to all Indian residents, while SSY is specifically for the girl child.

- Interest Rates: SSY generally offers higher interest rates than PPF but comes with specific conditions and a maturity period of 21 years.

- Contribution Limits: Both schemes have similar annual contribution limits, but SSY requires the account to be opened before the girl child turns 10.

PPF vs. Fixed Deposit (FD)

- Safety: Both PPF and FDs are considered safe, but PPF is government-backed, offering higher safety.

- Returns: PPF generally offers higher returns compared to regular FDs.

- Tax Benefits: PPF offers full tax exemption on both investments and returns, while FDs have taxable interest income.

What Are the Benefits of PPF?

The Public Provident Fund (PPF) is a popular long-term savings scheme in India that offers multiple benefits.

One of the key advantages is its tax-exempt status under Section 80C, where both the investment and returns are tax-free.

Additionally, PPF provides a fixed interest rate, which is higher than most fixed deposits and is backed by the government, ensuring safety and stability.

Another benefit is its 15-year lock-in period, encouraging disciplined savings while allowing partial withdrawals after the 7th year.

PPF also offers the option to extend the tenure in 5-year blocks, further compounding the investment. Moreover, the PPF account can be used as collateral for loans, providing financial flexibility without disrupting savings.

Applications of PPF Calculator

A PPF (Public Provident Fund) Calculator is an essential tool for individuals planning long-term savings with low risk.

It helps users estimate the maturity amount and interest earned over a specific period, based on their yearly contributions.

One of its key applications is in financial planning, allowing users to set realistic savings goals and track the growth of their PPF investment over time.

Taxpayers also benefit, as the calculator helps determine potential tax savings under Section 80C of the Income Tax Act.

It’s particularly useful for salaried professionals, freelancers, and self-employed individuals looking to build a secure retirement corpus.

Additionally, financial advisors use PPF calculators to provide clients with customized savings strategies.

Overall, it simplifies complex interest calculations, promotes better financial decisions, and supports long-term wealth creation.

Whether you're just starting to invest or reviewing your financial goals, the PPF calculator is a handy tool for smart money management.

Examples:

Example 1: Single Lump Sum Contribution

Initial Deposit: INR 1.5 lakh

Monthly Contribution: INR 0

Duration: 15 years

Interest Rate: 7.1%

Result: Maturity amount of approximately INR 2,85,435

Example 2: Regular Monthly Contributions

Monthly Contribution: INR 5,000

Duration: 15 years

Interest Rate: 7.1%

Result: Maturity amount of approximately INR 16,27,284

Advantages of PPF Calculator

A PPF (Public Provident Fund) Calculator offers several advantages for anyone planning long-term savings.

One of its biggest benefits is accuracy—it automatically calculates the estimated maturity amount based on your annual investment, tenure, and current interest rate, reducing the risk of manual errors.

It saves time by providing instant results, allowing users to focus on financial planning rather than complex calculations.

The calculator also helps visualize how your savings will grow over time, making it easier to set realistic financial goals.

It is user-friendly, requires no technical skills, and is accessible online for free. By offering clarity and transparency, it empowers investors to make informed decisions about their PPF contributions.

Whether you are a new investor or a seasoned saver, the PPF Calculator is a reliable tool for maximizing your returns and achieving long-term financial security.

You can also check out our Lumpsum Calculator to explore more investment options.

Frequently Asked Questions

Q1: What is the PPF Calculator?

Ans: The PPF Calculator is an online tool that helps calculate the maturity value of a Public Provident Fund investment based on your input details like initial deposit, monthly contribution, tenure, and interest rate.

Q2: How accurate is the PPF Calculator on www.toolerz.com?

Ans: Our calculator is highly accurate as it uses the current interest rates and standard PPF rules for compounding interest, ensuring precise calculations.

Q3: Can I use the calculator for partial withdrawals?

Ans: Yes, you can input the amount you plan to withdraw partially and the year to see its impact on your maturity value.

Q4: Is the PPF Calculator updated with the latest interest rates?

Ans: Yes, the calculator is regularly updated to reflect the current PPF interest rates announced by the government.

Q5: Does the PPF Calculator consider the compounding frequency?

Ans: Yes, the calculator considers the annual compounding frequency while calculating the returns.

Q6: Can I use the PPF Calculator for extended investment periods?

Ans: Yes, you can calculate returns for extended periods in blocks of 5 years after the initial 15-year tenure.

Q7: How does the calculator compare PPF with other investments?

Ans: The tool offers a side-by-side comparison of PPF returns with SIPs, FDs, and Sukanya Samriddhi Yojana.

Q8: Is the PPF Calculator free to use?

Ans: Yes, our PPF Calculator is completely free and requires no registration. www.toolerz.com

Q9: Can I access the calculator on mobile devices?

Ans: Yes, our PPF Calculator is mobile-friendly and can be accessed on any smartphone or tablet.

Q10: What is the minimum and maximum contribution allowed in PPF?

Ans: The minimum contribution is INR 500 per year, and the maximum is INR 1.5 lakh per annum.

Q11: Does the calculator provide a graphical representation of returns?

Ans: Yes, it provides a graphical representation to help you visualize the growth of your investment over time.

Q12: What Information is Required to Use a PPF Calculator?

Ans: To use a PPF Calculator, you need to enter:

Annual Deposit Amount

PPF Tenure (up to 15 years)

Current Interest Rate

Some calculators may also allow you to adjust the contribution frequency.

Q13: Can I use the PPF calculator for different investment amounts?

Ans: Yes, you can use the PPF calculator with different investment amounts. It allows you to check how changing the monthly or annual deposit affects the maturity value.

Q14: Can I use the calculator for monthly deposits?

Ans: Yes, many PPF calculators allow you to choose between yearly, half-yearly, quarterly, or monthly deposits. This helps you see how your savings grow with regular investments.

Q15: Can I change my PPF contributions every year?

Ans: Yes, you can change your contribution to the PPF account every year, as long as you contribute a minimum of ₹500 in a financial year. However, increasing your contributions can lead to higher returns at maturity.

Q16: Why should I use a PPF Calculator?

Ans:Using a PPF Calculator makes it easy to plan your savings. It helps you understand how much you will earn by the end of your 15-year investment and how much you need to invest yearly to reach your financial goals.

Q17: Can I calculate monthly PPF contributions using the calculator?

Ans:Yes, many PPF calculators allow you to choose monthly, quarterly, or yearly contributions, so you can see how different saving patterns affect your final returns.