RD CALCULATOR

What is Toolerz RD Calculator?

Toolerz RD Calculator (Recurring Deposit) is a Free Online Tool that estimates the maturity value earned on Recurring deposit schemes in India.

RD Calculator is one of the essential tools for investors. In this article, we have provided the functionalities of RD Calculators, and how to use them to make the right step towards your financial goals.

How to Use Toolerz RD Calculator?

RD Calculator from Toolerz is a simple yet powerful tool to calculate your returns on recurring deposits.

Irrespective of the bank you opted for recurring deposits, this tool gives accurate returns on your investment.

This tool is suitable for calculating the returns on recurring deposits in various banks like HDFC Bank, Kotak Bank, SBI, Union Bank, Canara Bank, etc.,

Here is the simple 3-step process to calculate your returns on your RD.

Step 1: Go to the website www.toolerz.com

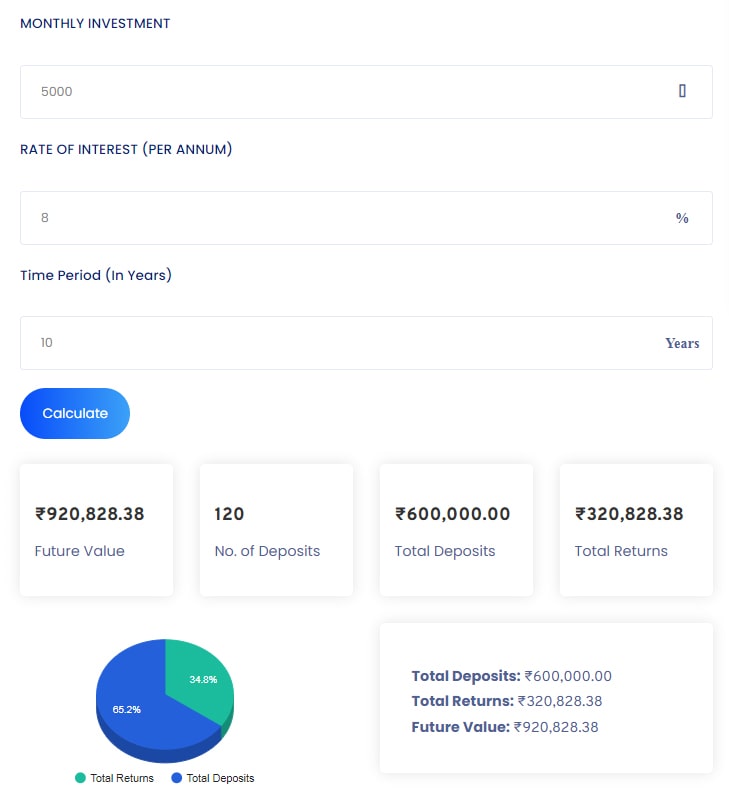

Step 2: Search for "RD Calculator" on the search bar. A new page opens up with the calculator tool

Step 3: Enter the input values like " monthly deposit amount ", " interest rate ", and " tenure ". Hit the Calculate button to get the returns.

What is Recurring Deposits?

Before understanding the benefits of an RD Calculator, it is essential to know the concept of Recurring Deposits.

Recurring Deposits (RDs) are financial instruments offered by banks and financial institutions that allow individuals to deposit a fixed amount regularly over a predefined period.

These deposits earn interest at a fixed rate, providing a secure and disciplined approach to savings.

You can estimate the returns on your RDs using simple online tools like "Toolerz RD Calculator".

The step-by-step procedure on how to utilize this toll has been given on this page.

The Recurring Deposit (RD) Calculator is a valuable tool for your financial journey, offering a user-friendly way to estimate returns on regular savings.

If you're also looking to invest in mutual funds, check out our SIP Calculator to estimate your returns on systematic investments.

Benefits of Using Toolerz RD Calculator:

The below lines give you a clear understanding of our RD Calculator and also provide the benefits of using our tool compared to other tools.

Accurate Interest Calculation:

Our RD Calculator is designed to execute accurate results for your investment plans. It employs the compound interest formula to provide accurate estimates of the maturity amount, taking into account both the principal amount and the interest.

Quick and User-Friendly:

One of the primary benefits of using our RD Calculator is its speed and easy-to-access features.

By entering details such as the monthly deposit amount, tenure, and interest rate, we can simply estimate the maturity amount.

The Only Tool You Need:

This calculator becomes a calculated tool for goal planning. Whether you're saving for a down payment on a home, a dream vacation, or your child's education, this calculator helps you set realistic targets by projecting the future value of your recurring deposits.

We have over 1000+ financial and other tools that are very useful in day-to-day life.

Post Office RD Calculator

Toolerz RD Calculator can also be used as a Post Office RD Calculator. You can calculate the maturity amount of your post office recurring deposits.

A Recurring Deposit is a savings plan offered by post offices in India, allowing individuals to deposit a fixed amount regularly over a period of time.

Post Office RD Interest Rate

The interest rate for Post Office Recurring Deposits is set by the government of India and is subject to periodic revisions.

The average interest rate of the Post Office RDs ranges from 5.8% to 6.8% per annum. More or less other private banks are also offering a similar rate of interest.

Key Features of RD Calculator

An RD (Recurring Deposit) calculator is a handy financial tool that helps you estimate the maturity amount of your recurring deposit. One of its key features is instant calculation just enter the monthly deposit amount, interest rate, and tenure, and the tool provides accurate results within seconds.

It also displays a clear breakdown of interest earned and total maturity value, helping you plan your savings effectively.

Another great feature is its user-friendly interface, suitable for both beginners and finance experts. Many RD calculators also support customizable options, allowing you to adjust variables to compare different plans or investment periods.

Whether you're planning short-term savings or long-term goals, the RD calculator helps you make informed financial decisions, track your progress, and achieve your targets with ease. It's a must-use tool for smart and hassle-free savings planning.

How does this tool Work?

The Post Office RD Calculator simplifies the process of calculating the maturity amount by considering key parameters such as the monthly deposit amount, tenure, and interest rate.

Here is a clear understanding of how the Post Office RD Calculator works:

Key Input Parameters:

The users have to enter the input parameters like monthly deposit amount, tenure, and the expected rate of interest to calculate the returns.

Monthly Deposit Amount:

Users need to input the fixed amount they intend to deposit every month into their RD account.

This amount remains constant throughout the tenure of the RD in Indian Post Office Schemes.

Tenure (Duration):

The tenure represents the period for which you plan to make regular monthly deposits. In the case of Post Office RDs, the tenure typically ranges from 5 to 10 years.

Interest Rate:

The interest rate is the rate at which the deposited amount earns interest. For Post Office RDs, this rate is set by the government and can be subject to periodic changes. The average interest ranges from 5.8% to 6.8% per annum.

What is the Maturity Amount in RD?

The maturity amount in a Recurring Deposit (RD) refers to the total amount you receive at the end of the deposit tenure. It includes the sum of all monthly deposits made during the RD period, along with the interest earned on those deposits.

The interest is compounded quarterly, which helps the investment grow steadily over time.

The formula used to calculate the RD maturity amount is:

M = P × n + Interest earned,

where P is the monthly deposit, n is the number of months, and the interest depends on the prevailing RD interest rate.

RDs are a popular choice for disciplined savings because they allow fixed monthly investments and offer guaranteed returns.

Using an RD calculator can help you quickly estimate your maturity amount based on your monthly deposit, interest rate, and tenure. It is a safe, low-risk way to plan for short- to medium-term financial goals

Applications of RD Calculator

The Recurring Deposit (RD) Calculator is a handy tool used to estimate the returns on a recurring deposit investment.

This tool is particularly useful for individuals who regularly invest a fixed amount in an RD account and want to understand the maturity amount, interest earned, and total savings at the end of the tenure.

The RD Calculator is widely used by investors to plan their finances effectively. It helps users determine how much they will earn over a given period, based on their monthly contribution, interest rate, and tenure.

Whether it's for saving for a future goal, education, or retirement, the RD calculator aids in making informed decisions.

For banks and financial institutions, this tool ensures transparency, allowing customers to visualize their investment growth.

By simplifying complex calculations, it saves time and provides an easy-to-understand overview of potential returns, making it an essential resource for all RD investors.

You can also check out our Lumpsum Calculator for one-time investment returns.

Advantages of RD Calculator

An RD (Recurring Deposit) Calculator offers several advantages for individuals planning to invest in recurring deposits.

One of the biggest benefits is the ability to estimate maturity value instantly, saving time and eliminating the need for complex manual calculations.

It allows users to adjust deposit amount, interest rate, and tenure to visualize different outcomes and make informed decisions.

The RD Calculator helps in goal-based planning, whether it's for education, travel, or emergency funds, by giving a clear picture of expected returns.

It's also a useful tool for comparing different bank schemes before investing. Easy to use and accessible online, it ensures transparency and accuracy in financial planning.

Overall, an RD Calculator simplifies the investment process and empowers users to manage their finances more confidently and efficiently.

Conclusion of RD Calculator

The RD Calculator is a valuable tool for anyone looking to invest smartly in a recurring deposit scheme. It offers a quick and accurate way to estimate the maturity amount based on your monthly contributions, interest rate, and tenure.

By providing clear insights into your potential savings, it helps you make informed financial decisions and plan effectively for your short- or long-term goals.

Whether you're saving for a future expense or building a financial cushion, the RD Calculator simplifies the process, making it accessible and stress-free.

Its user-friendly interface and instant results ensure better money management without the hassle of manual calculations. In conclusion, the RD Calculator is not just a convenience—it's a smart companion for secure and systematic saving.

Frequently Asked Questions

Q1. What is an RD Calculator?

Ans: An RD Calculator is a tool that helps you calculate the maturity amount of a Recurring Deposit (RD). It uses factors like the monthly deposit amount, interest rate, and tenure to give an estimate of your returns.

Q2. Why Should I Use an RD Calculator?

Ans: An RD Calculator is helpful because it:

Saves Time: Provides quick and accurate results.

Easy Comparison: Helps you compare different deposit plans.

Financial Planning: Allows you to plan your savings effectively.

Q3. Is the Result from an RD Calculator Accurate?

Ans: Yes, the result is generally accurate as it is based on the compound interest formula. However, minor variations may occur depending on bank policies or taxation.

Q4. Can I calculate the maturity value for different interest rates?

Ans: Yes, the RD calculator allows you to adjust the interest rate to see how it affects your maturity amount. This helps you choose the best option for your investment.

Q5. Who can use an RD calculator?

Ans: Anyone who wants to save regularly through a recurring deposit students, working professionals, or retirees can use the RD calculator to plan ahead.

Q6. Can I use the RD Calculator for any bank?

Ans: Yes, the calculator is general and works for any bank. Just make sure to enter the correct interest rate offered by your bank.

Q7. Is it free to use an online RD Calculator?

Ans: Absolutely. Most RD calculators available online are free, quick, and easy to use without any sign-up.https://www.toolerz.com/

Q8. Does the RD Calculator include tax deductions?

Ans: No, the RD Calculator typically does not account for taxes. The interest earned on RD is taxable, and you should consider the applicable tax rate while calculating your final returns.

Q9. Can I use the RD Calculator for premature withdrawals?

Ans: No, most RD Calculators do not account for premature withdrawals. The maturity amount displayed is based on the assumption that the entire deposit is held until the end of the tenure.

Q10. Can I calculate RD for different interest rates?

Ans: Yes, you can adjust the interest rate in the RD Calculator to see how changes in the interest rate affect the maturity amount. This is useful for comparing RD schemes from different banks.

Q11. Can I change the interest rate in the calculator?

Ans: Yes, most RD calculators let you enter the interest rate manually. This helps you compare RDs from different banks or financial institutions.