PART PAYMENT CALCULATOR

What is Toolerz Part Payment Calculator?

Toolerz Part Payment Calculator is an online tool designed to help borrowers calculate the effect of making a partial payment on their outstanding loan amount.

Partial payments, also known as part payments or prepayments, are additional payments made over and above the regular EMI (Equated Monthly Installment) towards a loan.

This helps in reducing the principal amount, thereby decreasing the interest burden and shortening the loan tenure.

Our Part Payment Calculator is particularly useful for home loans, personal loans, and other long-term loans, where the interest component forms a significant part of the total repayment amount.

How to Use Our Part Payment Calculator

Using our Part Payment Calculator is very simple. Here is a step-by-step guide to help you get started:

- Visit Our Website: Go to www.toolerz.com and visit the 'Part Payment Calculator' tool.

- Enter Loan Details:

- Loan Amount: Enter the total amount of your loan.

- Interest Rate: Input the interest rate applied to your loan.

- Loan Tenure: Provide the original tenure of your loan in months or years.

- EMI Amount: Specify the monthly EMI amount.

- Input Part Payment Details:

- Part Payment Amount: Enter the amount you wish to pay as a part payment.

- Payment Frequency: Select whether the part payment is a one-time payment or recurring (monthly, quarterly, yearly).

- Payment Start Date: Indicate the start date of your part payment.

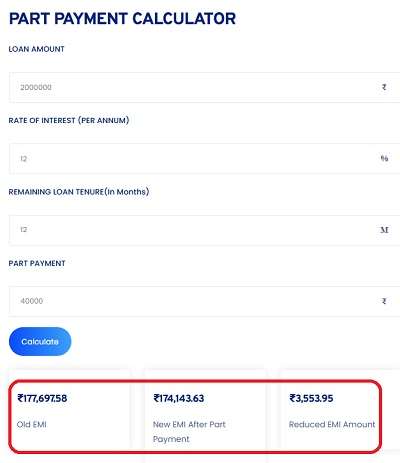

- View Results: Click on the ‘Calculate’ button to see the results, including the revised loan tenure, total interest saved, and updated EMI schedule.

- Analyze Graphs and Reports: Review the graphical representations and detailed reports to understand the impact of your part payment.

Benefits of Using Part Payment Calculator:

A part payment calculator is a smart financial tool that helps borrowers understand the impact of making extra payments on their loans.

One of its main benefits is showing how much interest you can save and how quickly you can reduce your loan tenure by paying a lump sum.

It’s especially useful for home loans, personal loans, or car loans. The calculator is easy to use just enter your loan details, EMI, and the part payment amount to get instant results.

It helps you make informed decisions about managing your debt more efficiently.

By using a part payment calculator, you can plan your finances better, reduce overall interest costs, and become debt-free faster.

Most calculators are free, online, and mobile-friendly. Whether you’re thinking of making a one-time payment or regular extra payments, this tool gives you a clear picture of the benefits, helping you stay in control of your finances.

Functionality:

The Part Payment Calculator uses advanced algorithms to compute the effect of partial payments on your loan. Here’s how it functions:

Initial Inputs: The calculator takes your loan details, including the amount, interest rate, tenure, and existing EMI.

Part Payment Details: It then takes the details of your part payment, including the amount and frequency.

Calculating the New Principal: After the part payment, the tool recalculates the principal amount by subtracting the part payment from the outstanding loan balance.

Interest Recalculation: The interest is recalculated based on the new principal amount, reducing the overall interest payable.

Updated EMI or Tenure: Depending on your preference, the calculator updates the EMI or the loan tenure to reflect the new repayment schedule.

Results Display: The final results display the revised loan tenure, interest saved, and the new EMI amount.

For other useful tools, check out our Age Calculator to quickly determine your exact age in years, months, and days

Key Features of Part Payment Calculator

A Part Payment Calculator is a helpful tool designed to simplify financial planning for borrowers. One of its key features is the ability to calculate how a lump-sum part payment can reduce your overall loan burden.

It instantly shows the revised EMI, loan tenure, or both—based on your preference. The tool supports various loan types, including home, personal, and auto loans, offering flexibility for different users.

Its user-friendly interface allows you to input original loan details and part payment amount with ease.

Real-time results help you make informed decisions about loan repayment strategies. Additionally, many calculators offer visual graphs to compare savings over time.

Whether you're trying to pay off your loan faster or save on interest, the Part Payment Calculator is a must-have financial planning aid.

It’s quick, reliable, and accessible online—making it ideal for both individuals and financial advisors.

Home Loan Part Payment Calculator

Our Part Payment Calculator is particularly effective for home loans. Home loans usually have a longer tenure and a higher interest component, making them ideal for part payments. By using our calculator, homeowners can:

- Reduce the Interest Burden: Even small part payments can significantly reduce the total interest payable over the loan's life.

- Shorten Loan Tenure: Partial payments help reduce the number of years you are tied to a mortgage, allowing you to become debt-free sooner.

- Flexible Payment Options: Choose between reducing the EMI amount or shortening the tenure, depending on your financial goals.

How to Calculate Partial Payment?

To calculate the impact of a partial payment on your loan, follow these steps:

Identify the Outstanding Loan Amount: Determine the remaining loan balance after regular EMIs.

Decide the Part Payment Amount: Choose how much you want to pay as a partial payment.

Calculate the New Principal: Subtract the part payment amount from the outstanding loan balance.

Recalculate Interest: Based on the new principal, recalculate the interest payable.

Determine the New EMI or Tenure: Adjust the EMI or tenure based on the new principal amount and interest rate.

What Is Part Payment of Home Loan EMI?

Part payment of a home loan EMI refers to making an additional payment towards the loan principal over and above the regular EMI.

This lump sum amount helps in reducing the outstanding principal, which subsequently lowers the interest burden.

As a result, either the loan tenure is shortened, or the monthly EMI amount is reduced, depending on the borrower’s preference.

Part payments are particularly beneficial when borrowers receive extra funds, such as bonuses or savings.

It helps in saving on interest costs and accelerating the loan repayment process. However, some lenders may charge a fee for part payments, so it’s essential to review the loan terms before proceeding.

Applications of Part Payment Calculator

A part payment calculator is an essential tool for individuals and businesses to manage partial payments on loans, bills, or purchases.

It helps in determining the remaining balance after making a part payment, which is crucial for tracking debts and understanding financial obligations.

One key application is in loan management, where users can input the part payment amount and calculate how it affects their outstanding balance, interest, and loan tenure.

This helps in making informed decisions about early repayments and understanding the impact on future payments.

In businesses, part payment calculators are useful for managing customer installments or advance payments on products and services.

They enable businesses to track payments more efficiently and maintain accurate financial records.

Overall, part payment calculators are indispensable tools for anyone looking to plan their finances, reduce debt effectively, or simply manage partial payments with ease.

Example: Paying 20% of Total Amount

Suppose you have a loan of $100,000 with an interest rate of 8% per annum and a tenure of 20 years. You decide to make a part payment of 20% of the total loan amount after 5 years. Here’s how it looks in a tabular format:

| Loan Details | Before Part Payment | After Part Payment |

|---|---|---|

| Loan Amount | Rs. 100,000 | Rs. 80,000 |

| Interest Rate | 8% | 8% |

| Loan Tenure | 20 years | 15 years |

| EMI | Rs. 836 | Rs. 671 |

| Total Interest Payable | Rs. 100,644 | Rs. 71,280 |

| Total Payment (Principal + Interest) | Rs. 200,644 | Rs. 151,280 |

| Interest Saved | - | Rs. 29,364 |

| Loan Tenure Reduced by | - | 5 years |

In this example, a 20% part payment of Rs. 20,000 reduces the total interest payable by Rs. 29,364 and shortens the loan tenure by 5 years.

To better plan your investments, you can also use our Step Up SIP Calculator to track how increasing your SIP investments over time can boost your returns.

Frequently Asked Questions

Q1: Can I use the Part Payment Calculator for loans with variable interest rates?

Ans: Yes, the Part Payment Calculator can be used for loans with variable interest rates. However, you should update the interest rate periodically as it changes to get accurate results.

Q2: How does making a part payment affect my credit score?

Ans: Making part payments can positively impact your credit score by demonstrating responsible loan management and reducing the outstanding balance. However, always ensure timely payments of the remaining EMIs.

Q3: Can the calculator be used for loans in different currencies?

Ans: Yes, the Part Payment Calculator can be adapted for loans in different currencies. You need to enter the loan amount and other details in the respective currency.

Q4: Does the calculator account for prepayment penalties?

Ans: The standard version of the calculator does not account for prepayment penalties. You should check with your lender about any penalties and adjust your calculations accordingly.

Q5: Is there a limit to how many part payments I can make?

Ans: There is no limit to the number of part payments you can make using the calculator. However, check with your lender about their policies regarding the frequency and amount of part payments.

Q6: How often should I make part payments to maximize savings?

Ans: The frequency of part payments depends on your financial situation. Making regular part payments, even if they are small, can significantly reduce your loan balance and interest over time.

Q7: Can the calculator help with loans that have balloon payments?

Ans: Yes, the calculator can help estimate the impact of part payments on loans with balloon payments. Enter the details of the balloon payment and the part payment to see how they affect your loan.

Q8: How do I interpret the graphical results provided by the calculator?

Ans: The graphical results typically show a visual representation of your loan balance, interest savings, and tenure reduction over time. They help you understand the impact of part payments at a glance.

Q9: Can I compare multiple scenarios using the calculator?

Ans: Yes, you can compare different scenarios by entering varying part payment amounts and frequencies to see how each scenario affects your loan balance and tenure.

Q10: What should I do if I encounter issues while using the calculator?

Ans: If you encounter issues, ensure you have entered all details correctly. If problems persist, contact our support team through the website for assistance.

Q11: Can the calculator handle loans with different repayment schedules?

Ans: Yes, the calculator can handle loans with different repayment schedules, including monthly, quarterly, and annual payments. Adjust the settings according to your loan's repayment schedule.

Q12: How do part payments affect the amortization schedule of my loan?

Ans: Part payments reduce the principal amount, which in turn reduces the interest payable over time. This can either lower your EMI or shorten the loan tenure, affecting your amortization schedule.

Q13: Will making part payments affect my loan’s EMI amount?

Ans: Making part payments can either reduce your EMI amount or shorten the loan tenure. You can choose how to adjust the EMI or tenure based on your preference and financial goals.

Q14: Can I use the calculator to plan for future part payments?

Ans: Yes, you can use the calculator to plan for future part payments by entering projected amounts and dates to see their potential impact on your loan.

Q15: Is the Part Payment Calculator suitable for both fixed and floating rate loans?

Ans: Yes, the calculator is suitable for both fixed and floating rate loans. For floating rate loans, ensure you update the interest rate as it changes to maintain accuracy.

Q16: Why should I use a Part Payment Calculator?

Ans: Using a Part Payment Calculator helps you:

Understand how much interest you can save.

Decide whether part payment is beneficial.

Compare the impact of different payment amounts.

Plan your loan repayment more effectively.

Q17: How can a part payment calculator help me?

Ans: It helps you understand how much interest you can save and how your EMI or loan period can change after making a part payment.

Q18: Do banks charge fees for part payment?

Ans: Some banks may charge a small fee, especially for fixed-rate loans. It's always a good idea to check with your lender before making a part payment.

Q19: Can I use the Part Payment Calculator for any type of loan?

Ans:Yes, you can use the Part Payment Calculator for various types of loans like personal loans, home loans, or car loans. Just enter the correct loan details, and the calculator will show the impact of your part payments.

Q20: What is a Part Payment Calculator?

Ans:A Part Payment Calculator helps you see how making extra payments on your loan can reduce your interest and overall loan term. It shows the savings you get by paying more than your regular EMI.

Q21: Can a Part Payment reduce my loan tenure?

Ans:Yes, making a part payment can reduce the time you take to repay the loan or lower your monthly EMI, depending on your choice.